2026 Housing Market Reset: What This Shift Really Means for Raleigh and the Triangle

The housing market is not crashing in 2026. It is also not rebounding. According to Redfin’s 2026 outlook, the market is entering what economists are calling The Great Housing Reset. This reset is defined by slower price growth, modest sales increases, and a long overdue rebalancing between wages and housing costs.

For owners, renters, and investors in the Triangle, this matters because the next few years will reward planning, patience, and local strategy rather than speculation or urgency.

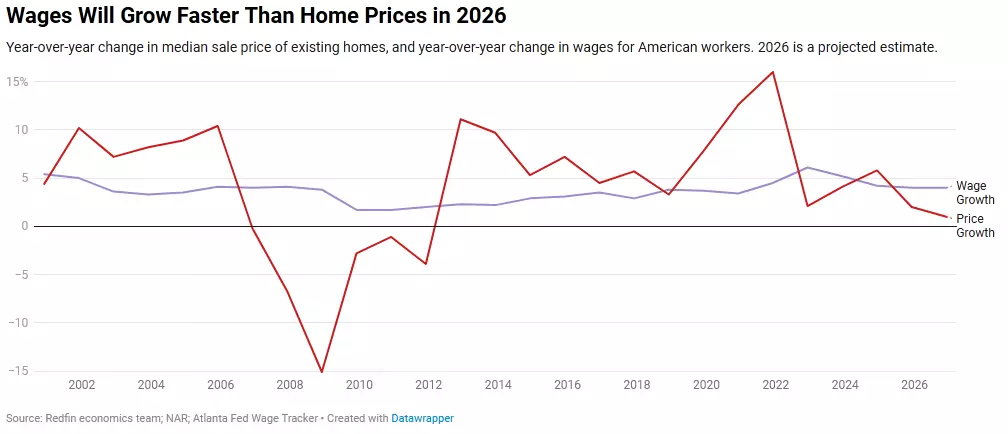

Wages Are Finally Catching Up to Home Prices

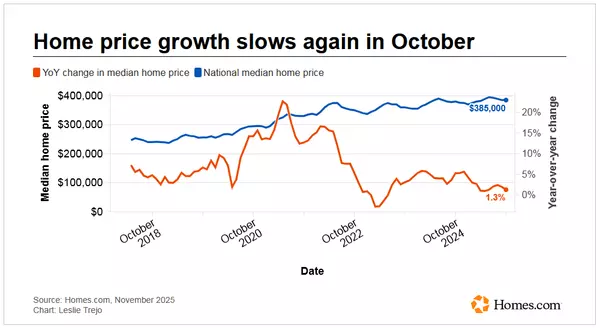

For the first time since the aftermath of the Great Recession, wages are projected to grow faster than home prices for a sustained period. Redfin estimates national home prices will rise only about 1 percent in 2026, while wages continue to climb at a steadier pace.

This is the foundation of improved affordability. Prices are not falling, but incomes are slowly closing the gap. In practical terms, this means monthly housing costs should grow more slowly than earnings. That shift brings some buyers back into the conversation, even if homeownership remains out of reach for many younger households.

In Raleigh and surrounding areas, where job growth and in-migration continue, this trend supports stability rather than volatility. Homes are less likely to see sharp corrections, but buyers gain more room to breathe.

Mortgage Rates Will Ease Slightly, But Not Enough to Spark a Boom

Redfin projects the 30-year fixed mortgage rate to average around 6.3 percent in 2026. That is down modestly from 2025, but still high compared to the ultra-low rates of the pandemic years.

This matters because rates in the low-6 percent range help affordability at the margins, not all at once. Buyers who were close to qualifying may re-enter the market, while others will continue to wait. Sellers should not expect rate-driven bidding wars to return.

For the Triangle market, this reinforces a familiar theme. Homes that are priced correctly and positioned well will attract interest. Homes priced for a 2021 buyer will not.

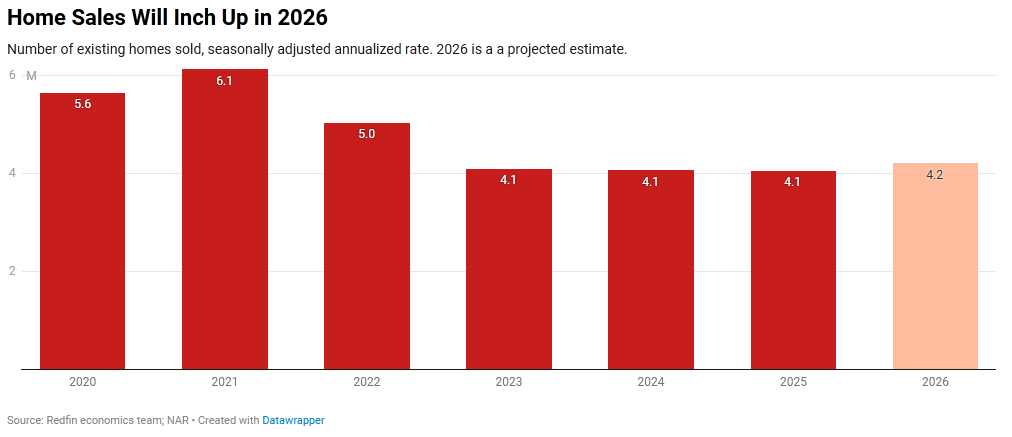

Home Sales Will Rise Slowly, Not Suddenly

Redfin expects existing home sales to rise about 3 percent in 2026, reaching an annualized pace of roughly 4.2 million sales nationwide. This is not a surge. It is a cautious step forward.

Sales are expected to increase because affordability improves just enough to pull some buyers off the sidelines. At the same time, many homeowners will continue to hold rather than sell,

especially those with low mortgage rates and strong equity positions. Locally, this suggests a market with more balance. Buyers may see more choices and less urgency. Sellers will need to lead with condition, pricing, and presentation rather than timing alone.

Rent Growth Will Continue as More Households Stay Renters

While homebuying eases slightly, rental demand is expected to remain strong. Redfin forecasts rents to rise about 2 to 3 percent in 2026, roughly in line with inflation. Apartment construction has slowed significantly since its post-pandemic surge, meaning fewer new units are coming online.

At the same time, many households will continue renting by necessity. Down payments remain high, mortgage payments remain elevated, and affordability gains are incremental rather than immediate.

For Triangle property owners, this reinforces the importance of disciplined rent strategy, tenant retention, and proactive property management. For tenants, it underscores why planning ahead and understanding market timing matters.

Household Patterns Are Shifting, and Housing Is Adapting

High housing costs are reshaping how people live. Redfin expects more shared households, more adult children living with parents, and more multigenerational living arrangements. Home renovations that accommodate extended family are becoming more common, especially in markets where moving is less appealing than improving what you already own.

This trend is already visible locally, from finished basements and converted garages to homes marketed for flexible living arrangements. It also affects rental demand, as roommates and shared leases become more common.

What This Reset Means Going Forward

The Great Housing Reset is not a single-year event. Redfin estimates it could take five years for housing affordability to return to anything resembling normal. The key takeaway for 2026 is not urgency. It is clarity.

For buyers, this is a market where patience and preparation matter. For sellers, realism and strategy are essential. For investors, the focus should be on long-term performance rather than short-term appreciation.

In Raleigh and the greater Triangle, fundamentals remain strong. Growth is steady, demand is durable, and the market is recalibrating rather than retreating.

If you are planning to buy, rent, sell, or hold property as the market resets, having a local strategy matters more than ever. For guidance grounded in Triangle-specific data and long-term planning, contact Tamisha Lane at 919.866.9302.

Categories

Recent Posts

GET MORE INFORMATION